The mobile-based platform Venmo enables users to transfer and share financial payments with friends, family members, and other contacts. The application functions as an all-purpose financial tool that supports both dining expenses and monthly dormitory rent payments.

Through its fast and casual transaction features, Venmo makes money exchange effortless, allowing users to accomplish this task effortlessly. Users need to link their bank or debit account and decide payment recipients before typing the amount, which initiates instant transfers. Money appears quickly after sending a transaction that operates as easily as sending a message.

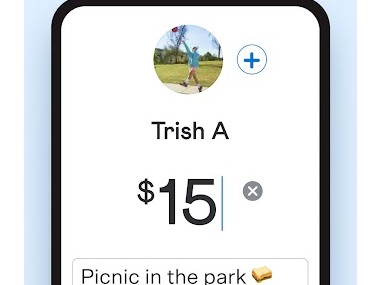

Most users enjoy Venmo due to its feature, which adds personalization during payments. Every transaction on Venmo includes the option to include personal messages and jokes along with emojis that become visible on the social-style feed when set as public. Users create little functional interactions by paying through the platform instead of traditional payment methods.

The PayPal ownership of Venmo delivers a casual approach with personal user orientation alongside its friendly atmosphere as opposed to a business operation. Venmo enables users to conduct fast and entertaining small-money transfers through mobile access without needing any cash.

Why Should I Download Venmo?

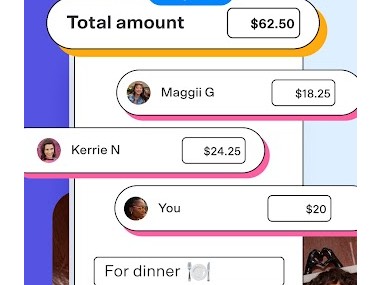

Venmo enables effortless handling of small payments, which causes users to keep downloading it. Venmo serves as a seamless solution to help users overcome difficulties with dividing restaurant expenses and apartment rent or group present costs. Only a user’s account name or phone number is necessary to transfer funds, even without access to their banking details.

Using Venmo requires just a few clicks, after which you input funds alongside optional messages or emojis before successfully sending money. The system requires no complicated setup, so users reach their payment destination through an easy process that lacks additional confirmation steps unless they opt for extra security checks. This platform follows the user experience of sending texts.

The payment functionality of this app succeeds best when used with personal friends. Everyone’s on it. The person who obtained concert tickets or delivered takeout allows users to use Venmo to process swift payments. It’s done in seconds. With Venmo, you avoid needing cash on you and eliminate the need to calculate change amounts.

The payment process connects your bank account or card directly to theirs without any intermediary system involved. You have two excellent options when receiving payments through Venmo because you can either transfer the funds to your bank account or store the money in your Venmo balance to send payments or retransfer later.

The payment system brings forth a reassuring experience because everything stays visible. The payment histories for both sent and received payments appear in your account's records. The platform provides easy access to review dates of sales payments, together with payment amounts and transaction purposes in your payment history. The payment process becomes clear because Venmo stores a record of payments that eliminates the uncertainty caused by memory lapses. All payment data remains organized at Venmo, where you can find detailed documentation of all activities.

Closeness to security features determines why users maintain comfort when using Venmo. Payroll tracking with encryption becomes possible through Venmo's security system, which also allows users to add PIN protection or activate two-factor authentication.

The secure option lets you handle payment visibility because you can specify settings between public and private, and friends-only views. The feature provides a minor convenience that makes a difference in the user's experience. The system provides flexible payment methods without any additional setup hassle.

Is Venmo Free?

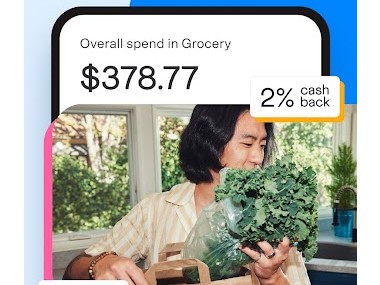

Standard personal payments on Venmo remain free of charge when users link their bank accounts and debit cards. Users can see payment fees for card transfers and bank transfers at the time of checkout before finishing the transaction.

What Operating Systems Are Compatible with Venmo?

Mobile users can access Venmo on both iOS and Android platforms without any connectivity issues. You can fetch Venmo from both the App Store and the Google Play Store. The system requires basic mobile or tablet operation and operates without exceeding storage capacity or technical system requirements.

The full desktop interface is missing from Venmo, but users can check their account through the website. Users will find that the app represents its core functionality by providing a quick and small platform that functions from any location.

What Are the Alternatives to Venmo?

Other valid payment options exist for different situations since Venmo fails to satisfy every preference.

One popular option is Skrill. Skrill achieves worldwide functionalities in payment transfers. Using the platform enables borderless money transfers between accounts for different currencies, and it supports crypto transactions. The platform functions as a secure electronic payment warehouse that provides ideal payment solutions for independent workers and remote staff, and people requiring foreign currency transfer services. You have three payment options through Skrill, including prepaid card linkage and both withdrawal and balanced retention features. The platform operates with basic functionality that benefits users' financial options rather than supporting impromptu informal payments.

Stripe serves as an essential business tool for payment processing, although its functionality differs from typical peer-to-peer programs. The payment platform Stripe exists to facilitate business transactions between customers and website and mobile app companies instead of serving peer-to-peer payments. Stripe serves commercial operations by providing subscription payment functions alongside detailed monetary analysis and immediate payment transfers. The platform does not function as a storage space, and it lacks goals to act socially or engage with everyday interactions. When you run a selling business instead of a sending operation, Stripe emerges as the top selection by platform users because it offers combined power with speed and background functionality. The focus of this platform remains infrastructure above all else, since it doesn't support social interaction features.

PayPal operates under its own principles to provide services that differ from Venmo, although both platforms belong to PayPal. Through PayPal, customers can send and receive business payments while conducting online shopping activities and generating invoices, along with setting up subscriptions and performing international transfer operations. People from across the globe accept this platform because it provides users with extensive control over intricate financial dealings. Although Venmo offers a more laid-back atmosphere while operating, PayPal succeeds as an advanced payment option for users who depend on crucial features such as extended security measures and business integration capabilities, and e-commerce platform connections. Users occasionally note the formal nature, but the system provides extensive features beyond its primary sympathetic functionality.